A guy I once dated had this mantra: “I’ll do what I want, when I want.” This motto proved problematic when we’d get into epic battles over nitpicky matters, but admittedly, there was something compelling about the idea. I mean, who hasn’t wanted to ditch the daily drudge for a big-ticket bucket-list item, whether it’s recording an album or starting a business? Or paying off a huge chunk of debt so they can finally make headway in other parts of their lives? Or perhaps kicking their nitpicky boyfriend to the curb?

Enter the fuck-off fund. For the unfamiliar, Paulette Perhach wrote an intimate piece on the importance of establishing such a fund. So what’s the difference between, say, a regular rainy-day fund and a fuck-off fund?

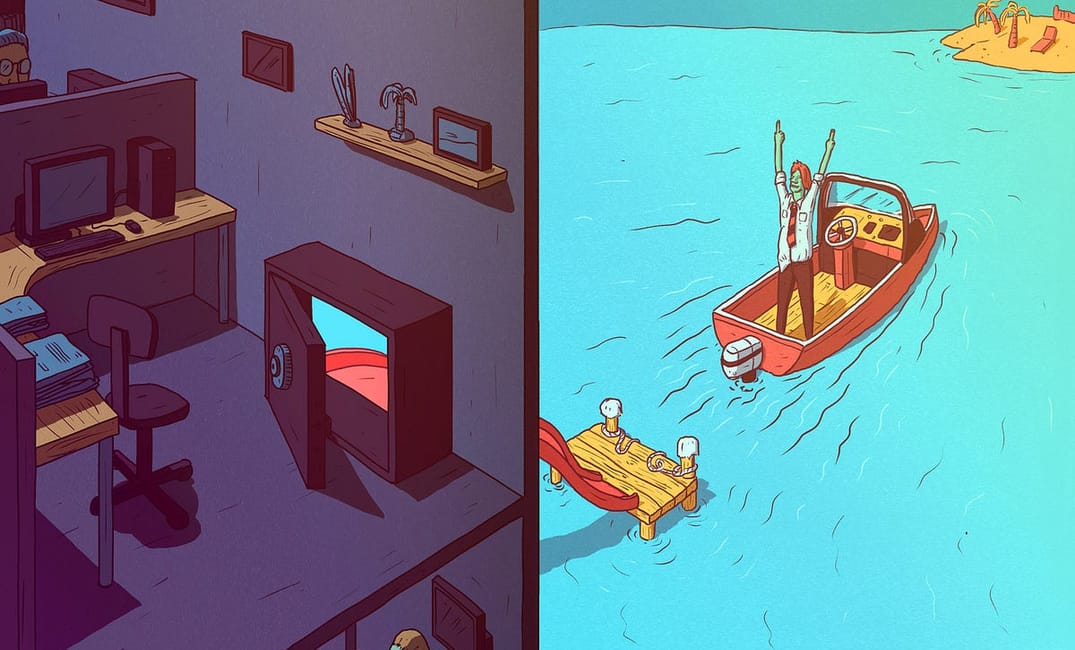

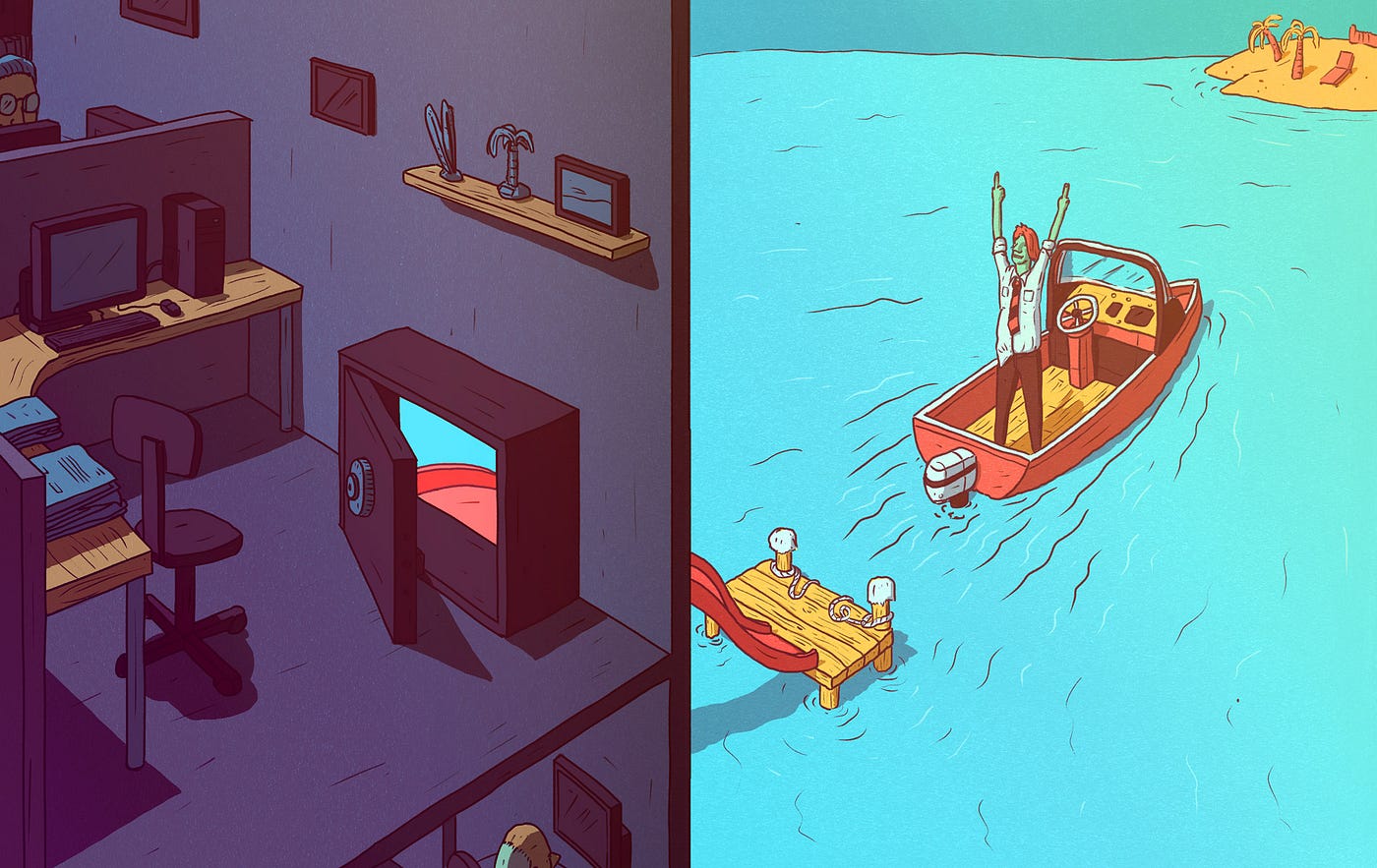

A fuck-off fund is about exerting control of your money so you can live in a more intentional way—so that you can give yourself choices and have agency. For instance, while it wouldn’t kill you to stay at the stagnant job you hate, with a fuck-off fund, you’d have a safety net with which to quit and go back to school for a little while. Or if things are going south with your significant other, you don’t have to stay in a relationship that’s no longer working out. You have the wherewithal to part ways and move out.

Whereas an emergency fund stems from a place of desperation, a fuck-off fund is about empowerment.

“It’s essential to have a fuck-off fund so you don’t have to limit your choices and you can do what you need to do for your own physical and emotional well-being,” explains Melanie Lockert of the blog Dear Debt. “It gives you the upper hand.”

I’ve been diligently putting money away toward a fuck-off fund since my first full-time gig, and it’s helped out many times. For instance, I didn’t fret when my live-in boyfriend and I broke up a few years ago. He moved out, and I could cover the rent long enough to get my shit together and didn’t have to enter an awkward situation of us living together longer than we wanted to because of financial circumstances. I didn’t have to compromise my heart or any other part of me because I was tight on money. Sure, I could have stuck it out for a few extra months and saved the rent money, but what kind of a way to live is that?

Instead of waiting until you’re stuck, why not start saving now? Here’s how to go about shoring up some reserves:

Set Up a Fund

Before you do anything else, set up the freakin’ fund. All this means is creating a separate account to sock away funds on the regular. This is probably the easiest thing you will do. Most bank accounts offer a savings-goal feature, where you can set up a goal for your fund.

You can then automate the fund so that X amount goes into it every month, or put money in whenever you can. Now, as someone who obsesses over ways to go about saving one’s beans, I opt for the lazy route. I personally recommend automating funds toward your account, even if it’s just a few measly bucks a month.

This is the way to go, especially if you’re terrible with money. When you set up a structure and a system for saving money, the less you have to think about your money, and the easier it gets.

Slay the Debt Beast

Sure, it’s difficult to fathom saving $5,000 — $10,000 when you’ve got rent to pay. And the sad truth is that nearly half of households in America can’t afford a $400 emergency. That being said, you’re going to be way happier if you’re among that other half of households that can afford to get by in an emergency.

For starters, take a look at your debt, your financial obligations and any other money goals you have on your plate. When it comes to paying down debt, there are many ways to slay the debt beast. Most importantly, pay off your credit cards and other high-interest debt as quickly as possible. As long as you’re a slave to debt, you’re severely limiting your fuck-off options.

Go for the Cost-Neutral Approach

My friend Greg taught me the awesome method of making things “cost neutral,” which means nullifying the costs of just about anything. In other words, if you’re going to add an expense to your budget, find a way to offset that cost somewhere else in your economic ecosystem.

As a homeowner with his own barbershop in Chicago, Greg takes the money he makes from the hair products he sells in his shop and uses it to pay off most of his business’s utility bills. And the rent money he collects from renting out two of the three units in his house pays for the mortgage. So how can one find ways to make things cost neutral even if one doesn’t own a home or a business? Be resourceful! You can rent out your driveway or help out at the reception desk in exchange for classes at your favorite yoga studio. And if you can’t find a way to offset costs, don’t add anything to your budget!

Swap It Up

Another easy way you can save money is to swap gear or clothing. By swapping clothes, art supplies, instruments and what have you, you’re not only getting a better deal but also strengthening bonds with other women who are also striving to set up their own FOFs. Creating community with fellow kick-ass pals around this aspiration could help keep you in check. This guy traded up a paper clip into a house, so you can probably finagle some extra value out of whatever useless crap you have lying around the house.

Anger Is a Gift

Anger, frustration, despair and other negative feelings can give you a kick in the behind to take action.

One thing to ask yourself is how urgent it is for you to set up such a fund. How much longer can you go to your day job and feel a tiny part of yourself dying until you absolutely can’t handle it any more?

Lockert has the brilliant idea of taking a jar and putting a piece of paper into it containing a word, a person or a situation that angers you. Maybe it’s a coworker. “Pick someone or something you’d essentially want to say ‘fuck off” to,” Lockert suggests. “Use that jar to save your change, your extra bills in your pocket and any bonuses.” Skip meals. Sell your ovaries. Work as a mourner at a funeral, or make yourself available as a friend for rent (yes, these are actual things). Airbnb your bed out while you sleep in your car.

Whatever adds to your temporary misery will motivate you all the more to spitefully save.

Of course, it’s far easier said than done. But it’s entirely possible. If you don’t make it a priority, it will never happen. What having a fuck-off fund essentially boils down to is having the means to carve out an existence on the basis of your own terms. And can you really put a price tag on that?