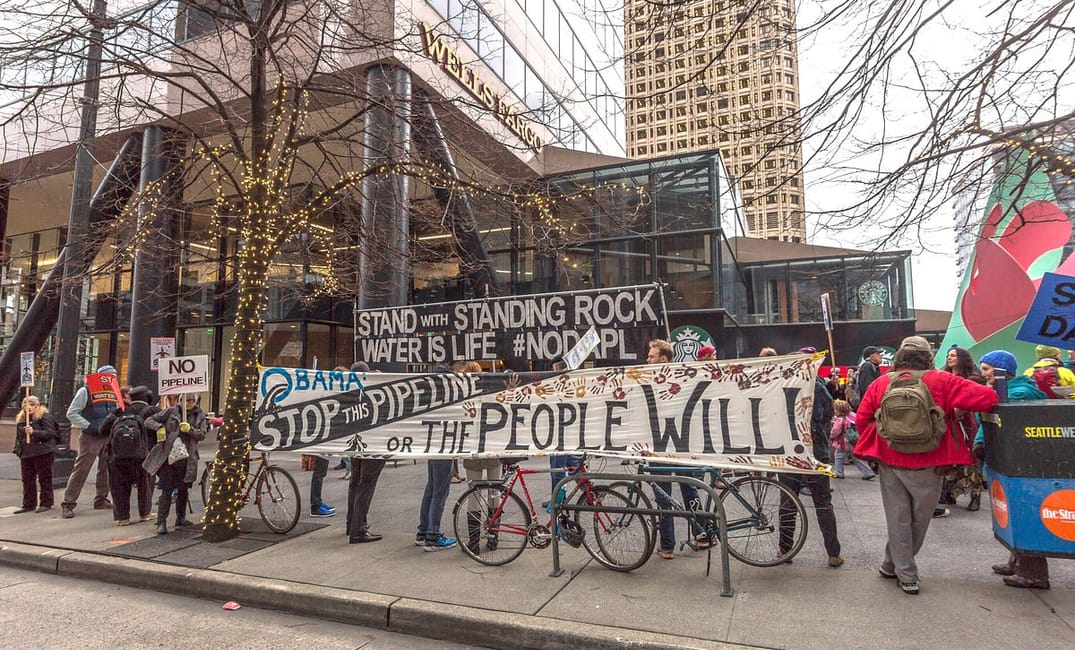

For the latter half of 2016, the public resistance against the Dakota Access Pipeline (DAPL) captivated hearts across the nation and the world. Thousands of indigenous and nonindigenous “water protectors” gathered at the Sacred Stone Camp within the Standing Rock Indian Reservation to prevent Energy Transfer Partners and Sunoco Logistics from invading ancestral tribal land with a pipeline designed to channel oil beneath the Missouri River.

On December 4, the US Army Corps of Engineers denied the easement that would have allowed the pipeline to proceed across the river. Yet the battle for indigenous water rights is far from over. The corporations behind the DAPL immediately responded with a statement reassuring their investors that they would find a way to proceed despite the government injunction. President-elect Donald Trump supports the pipeline and once had as much as $1 million invested in Energy Transfer Partners. The political tide may be washing against the water protectors.

Many of these investors are morally opaque national banks. Bank of America, HSBC, UBS, Wells Fargo, Chase and Citibank are named in various public archives as lenders or partners in groups that support the DAPL. Food & Water Watch published a list of 38 major financial institutions that are bankrolling this pipeline project and others like it. The divestment action website defunddapl.org is distributing a list of bank CEOs and other executives who are directly involved in the DAPL project.

A growing number of Americans are choosing to open accounts with credit unions — nonprofit and member-owned money-saving cooperatives that provide an alternative to for-profit banking institutions. Whereas a typical bank is run by career financial executives, a credit union is run by a volunteer board of directors who are elected by the organization’s member-owners. If you open an account, you are a member-owner, and each member has an equal say in how the union operates. One member’s savings become another member’s loan. Hence, instead of investing in the DAPL and who-knows-what-else, you are investing in your neighbors.

This article is a guide to removing your money from the banks that continue to pour their money into the DAPL and other pipeline projects. I will explain how to make your divestment a statement. I will then review local and federal credit unions that provide a more palatable alternative to your current bank. Finally, I will explain what it means for large financial institutions to fund the Dakota Access Pipeline.

Divestment is more of a mindset than a single action. It is the intention and practice of keeping your money from feeding things that you know are wrong. Divesting can send a powerful message to the parties responsible and inspire others to follow your lead. By exercising more control over what your money feeds, you can lessen your own (functionally nonconsensual) contribution to pipeline projects like the DAPL.

How to Make Your Divestment a Statement

1. Visit a branch of your DAPL-funding bank. State your intention to end all aspects of your financial relationship with the bank. Close your accounts, cards, loans, mortgages and any other ties. If you plan to move your money to a specific credit union, ask for a check containing your entire balance to be made out to that credit union for an easy transfer.

2. Speak to the branch manager or write them a letter that explains your reasons for leaving.

3. Make it public. Share your action on social media using hashtags like #NoDAPL and #DeFundDAPL, if you’re into that. Consider logging the sum of your divested balance at defunddapl.org. As of January 1, 2016, private citizens had removed more than $42 million from organizations that are funding the pipeline.

4. Move your money to somewhere trustworthy. Find a credit union in your area by using a search engine, asking around or entering your address at CULookup.com. The National Credit Union Administration also offers a useful research tool. Connect for the Cause is a credit-union advocacy network created by the California and Nevada Credit Union Leagues.

A Selection of Bay Area Credit Unions (in no particular order)

● San Francisco Fire Credit Union: This organization arose in 1951 to serve the firefighters of San Francisco, but you need not be a firefighter to join so long as you live, work, worship or attend school in San Francisco, San Mateo or Marin Counties. There are three branches in San Francisco and various partner locations throughout the Bay Area — plus SFFCU refunds ATM transaction fees for your first 10 transactions each month. You can apply online.

● San Francisco Federal Credit Union: This organization has been around since 1954. It supports its community by financing tenants in common (collectively owned) properties and operating a “Furry Fund” for members’ pet services. The focus may be local, but members can access a network of more than 29,000 free ATMs throughout the United States. SF Federal deposits are federally insured for up to $250,000 per depositor. You can open an account online.

● Provident Credit Union: Provident was founded in 1950 to serve the California Teachers Association, but in the intervening years, it has grown to manage more than $2.1 billion in assets. It comes well reviewed by financial-institution-rating agency BauerFinancial and is one of the largest credit unions in the country. Provident offers a nationwide branch network and worldwide ATM services, so this is a good option for frequent travelers. Deposits are federally insured, and you can apply online.

● Redwood Credit Union: RCU is a respected local credit union that has been managing money since 1950. They offer 16 branches, more than 30,000 free ATM locations and comprehensive online services for more than 220,000 members. You can join and apply online if you live in San Francisco, Sonoma, Marin, Napa, Mendocino, Lake, Solano or Contra Costa Counties.

● Patelco Credit Union: This 80 year-old California institution is one of the largest credit unions in the US, with $5 billion in assets and 300,000 members nationwide. There are 36 branches, 6,000 shared-service branches and 30,000+ surcharge-free ATMs (including 7- Eleven and Costco stores). Their size means a less personable experience, but people from all walks of life still choose this nonprofit banking group for its convenience, equitability and minimal membership requirements. You can apply online.

● Northeast Community Federal Credit Union: NECFCU primarily serves the Tenderloin, Chinatown and SOMA neighborhoods of San Francisco, although you are welcome to join as long as you live in the city or are active in one of the aforementioned districts. This hyper-local but federally insured credit union supports grassroots community development by fostering financial stability, economic literacy and generous loan rates for small businesses and homeowners. You need to apply in person.

● Technology Credit Union: In 1960, a group of entrepreneurs and high-tech industry leaders founded Tech CU in Silicon Valley. Members volunteer at and donate to organizations that support STEM education, financial literacy and affordable housing. There are 10 full-service branches throughout the Bay Area serving more than 70,000 members. You can apply online.

● Mechanics Bank: This is not a credit union but is a 100-year-old locally owned bank that invests in the Bay Area with a slew of community-support activities. There are 33 offices throughout Northern California, most of them in the East Bay.

How Banks are Funding the DAPL and Why Divestment Helps

If you are like most Americans, you maintain a checking or savings account in a large national bank. National banks are convenient because they are stable and maintain branches in many locations (for instance, Wells Fargo has 6,200 branches and 12,500 ATMs across 40 states, as well as the resources to build out many amenities, like support staff and mobile apps). They grow by making money off of that money through investments and interest rates. If you have money in an account with Bank of America, it is not stored in one location — or, strictly speaking, in any physical place at all. The money itself is distributed throughout various nebulous and far-reaching investment relationships. It is easy for large financial corporations to invest in ethically questionable ventures because their wealth, as a tool and an abstraction, becomes unhinged from direct human judgment.

Author and environmental advocate Bill McKibben of 350.org suggests that banks are more responsive to public pressure, while fossil-fuel-industry corporations are responsive to banks because their pipeline projects rest upon loans and lines of credit. Each of us plays a small role in the struggle between communities and fossil-fuel industries, but we can effect great change by making small choices collectively.

Think for yourself and do your research. Talk to credit-union support staff if you’re still undecided. Divesting is by no means the only way to help foster a more equitable America, but it’s a relatively straightforward measure with a powerful and immediate impact.