Californians should vote NO on Prop 22, which if passed would exempt app-based transportation and delivery companies like Uber and Lyft from providing employee benefits to certain drivers. These ride-share and delivery tech companies have spent millions on putting forth this proposition in response to California’s AB-5 “gig worker bill” that went into effect on January 1, 2020, and requires companies to reclassify certain independent contractors as employees, complete with benefits.

Here, I’ve tried to answer some questions from voters hesitant to vote no and am happy to add to this list if people have other questions.

For people who want to read the text themselves, you can do so here.

More importantly, this is the ugliest version of money in politics. Gig platforms lobbied hard last summer to keep AB-5 from passing or to see that their industries were exempt from the law. They were unsuccessful. Now, they are spending $200 million-plus in marketing a proposition they wrote themselves. They are literally writing their own rules. When you have corporations writing their own regulations on how to treat a low-wage, largely people of color workforce, Californians cannot tolerate this blatant abuse of power.

Second, the proposition sets thresholds to qualify for wage guarantees and benefits so high, that the industry wouldn’t need to change much at all. If it were to pass, these companies would also be able to act this way in perpetuity, given that any passed proposition takes a ⅞ supermajority to overturn.

Sign up for The Bold Italic newsletter to get the best of the Bay Area in your inbox every week.

1. If the proposition fails, will my fares go up?

Gig platforms may decide to do that. But they definitely don’t have to. Companies could just reduce their commission from 40% to ~15% to comply with all labor/employment laws and keep prices the same. Check the math here.

2. But I heard drivers want Prop 22 to pass. Is that not true?!

Firstly, gig platforms have been extremely manipulative in getting workers to express support for Prop 22/against AB-5. Some tactics I have seen firsthand include offering free tacos, forcing drivers to accept that they support the proposition before being able to enter the app, and paying drivers $1,000 to appear in commercials. So right off the bat, I don’t trust a lot of their “survey data.” But yes — some drivers are scared they’ll lose their jobs if this were to fail, and many fear losing flexibility of hours.

On the number of drivers, for sure, platforms will try some shady tactics. For instance, in New York, Uber started locking drivers out of the app to comply with minimum wage requirements, rather than just paying a minimum wage. But if the platforms have to reduce the number of workers on their platforms, this is an admission that these workers are in fact not making minimum wage.

On flexibility, the author of this law, California Assemblywoman Lorena Gonzalez, has been very clear that it is not an attack on a flexible work schedule. When I spoke with her team, they confirmed that they are open to piece-rate payment (for example, per trip), which would allow workers to maintain flexible hours. Again, if this does not happen, it is completely at the discretion of gig platforms, not inherent to the law.

Lastly, it’s really important to figure out what type of driver you’re speaking with. Are you talking to someone who does two hours every month? Or are you talking to someone who does platform work 30+ hours a week for the past few months or years? These more full-time drivers are more likely to oppose Prop 22, and given their greater commitment to this work, the opinions of long-term platform workers who work many hours on the platforms should be more heavily weighted.

3. But isn’t Prop 22 is generous? It’s offering more than minimum wage and health care to some drivers, right?

Okay — let’s break this down.

1. Minimum wage

The 120% of minimum wage guarantee in this proposition is only for engaged time (picking up and on-trip time). It does not include any passive time waiting for trips. A study from Berkeley Labor Center shows that, at pre-pandemic usage rates, which were higher than today, the proposition would result in an hourly wage of $5.64. By comparison, California’s minimum wage is $13 for employers with more than 26 employees, and even higher in major cities (for example, $15.59 in San Francisco). Also, to calculate the minimum wage, the proposition uses $0.30 per mile expense, whereas the IRS recommends $0.58. Lastly, this minimum wage amount includes incentives and bonuses, which are almost always tied to trip volumes, which further violates the independence inherent to classifying someone as an independent contractor.

2. Health insurance

The ballot proposes to cover:

- 100% of average ACA plan if average >25 hours per week of engaged time per week over the calendar quarter.

- 50% of average ACA plan if average 15–25 hours per week of engaged time per week over the calendar quarter.

So, this looks fair at first. But the first thing to remember is that engaged time is only a percentage of the total time on the road. For instance, when New York City was setting a minimum wage, they used a utilization rate of 58%. So let’s assume that the utilization rate in California is 60% (which it absolutely has not been especially in the pandemic), so to qualify for the 100% subsidy, you in fact need to work 42 hours a week. For 15 hours of engaged time, that’s 25 hours a week of real working time.

Now here’s the kicker — you have to work those hours ON A SINGLE PLATFORM. The vast majority of gig workers work across several platforms: Uber, Lyft, DoorDash, etc. To get health care, workers would have to choose a single app — or work 80+ hours a week. This again is basically getting workers on a full-time schedule, further violation of the independence that is meant to be inherent to being an independent contractor.

If workers were employees, they would qualify for the Affordable Care Act’s employer mandate, as well as city ordinances focused on health care. For instance, in San Francisco, employers have to contribute $3.08 per hour toward health care if an employee has been with the company at least 90 days and works at least eight hours a week. This defined contribution model based on a lower hours threshold is much more appropriate for platform workers.

3. Occupational accident

Occupational accident, which is basically like workers’ compensation for independent contractors, is actually a great product. It pays medical bills and a percentage of lost income if someone gets sick or hurt on the job. But they don’t need Prop 22 to pass to pay for it. Several of the delivery companies, including Postmates and Instacart, already offer it to their workers. Uber and Lyft don’t offer this, but could and should, independent of Prop 22 passing. That said, this only covers workers who get sick or are injured on the job. This can be really hard to prove (for example, if someone passes away from the coronavirus, was this from a customer or another interaction?), so opens up the risk of widespread claim denials.

4. What benefits are important and not included in Prop 22?

1. Paid time off

Paid time off is the most in-demand benefit requested by drivers, and is not included in the proposition. If workers were employees, they would qualify for paid time off (one hour for every 30 hours worked, up to an accrued 72 hours). The lack of paid time off makes gig work extremely precarious. If people don’t have money for a car repair or get sick or want to go on vacation, that’s a day of lost income.

2. Overtime

The workers who do the majority of the trips on platforms (though not the majority of workers registered on the platform) work more than 40 hours a week (in total across multiple platforms). Given their low salaries, as employees, they would qualify for overtime, which is 1.5–2x pay.

3. Unemployment

I cannot emphasize enough how important this is. My estimation is close to 95%+ of gig platform workers went on unemployment during the pandemic. Originally, no independent contractors qualified for unemployment; a special exception was made for pandemic unemployment assistance through the CARES Act. This was a clunky process that left people without income, from wages or unemployment, for months. I personally helped hundreds of platform workers navigate the complicated forms on state unemployment websites.

Not only are contractors generally ineligible for unemployment, but any unemployment paid to contractors is subsidized by taxpayers. All employers have to pay a federal unemployment tax of 6% of the first $7,000 paid to each employee. In other words, unemployment for employees is paid for by companies. Unemployment for contractors is paid for by your tax dollars. Uber and Lyft alone owe $413 million to California. More detail here.

There are a bunch more protections that contractors are ineligible for (for example, paid family leave, state disability, tax-advantaged tuition reimbursement accounts), but the ones above are the ones brought up by drivers most often.

5. Well, couldn’t we just change the laws to extend these protections to contractors?

Yes, we could, and we should eliminate the massive incentives to misclassify workers. But this is like fighting for civil rights. It will take a generation, at least. We have an opportunity to give these rights to 400,000 Californians this November.

6. If wages and conditions are so bad, why do 4 million people choose to work on these platforms?

Jobs are sticky. A lot of people made investments or decisions several years ago when rates were double what they are now. They bought cars. They quit jobs. They had another child.

Then came a series of bait-and-switch changes by gig platforms, most notably price cuts and a switch to up-front pricing which led to completely opaque commission rates. Now, workers are locked-in to servicing their expenses. Almost every full-time driver I know is exploring other opportunities — from getting a job in an Amazon warehouse to getting a stockbroker license. But these opportunities don’t develop overnight and, in the interim, hard work deserves to be appropriately compensated.

That said, the average tenure on these platforms, pre-pandemic, was around three months, in part because platforms advertise gross, rather than net, wages, misrepresenting the potential earnings one can make on the platform.

7. But these companies lose so much money, how can they comply with AB-5 and still survive?

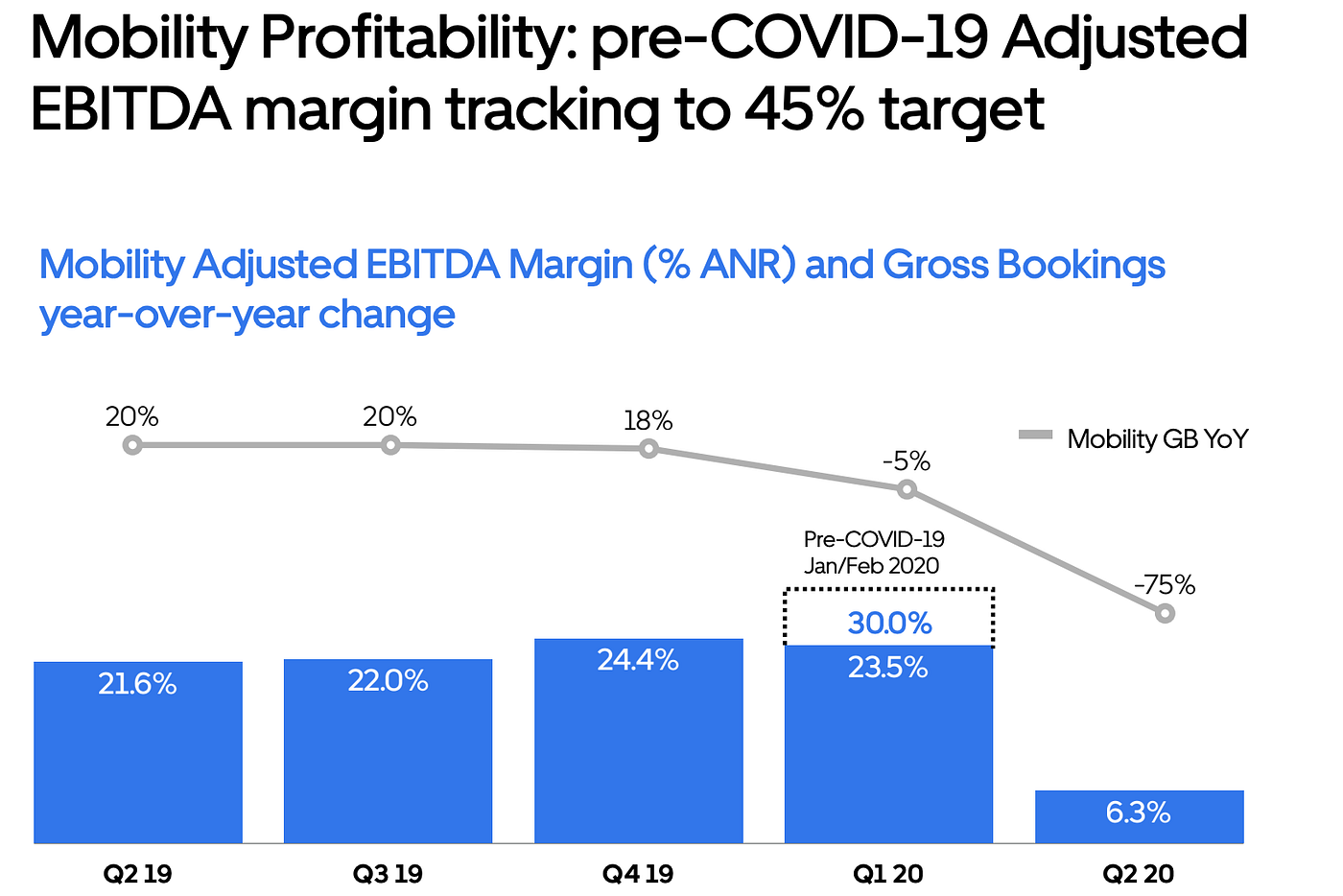

According to Uber’s most recent 10Q, the company’s EBITDA margin on ride-share is 25%. So they’re making bank on drivers but just investing in autonomous vehicles/flight/“moonshots.” These companies are trying to maximize the profitability of their core business to get into other transportation verticals, but they’re doing it by externalizing costs onto drivers.

8. Who will this law apply to?

This law applies to “app-based rideshare and delivery drivers.” So think Uber, Lyft, Postmates, DoorDash, Instacart. But this would not apply to sellers on Etsy, writers on Medium (oh hey!), and other “gig workers.”

9. If Prop 22 doesn’t pass, won’t Uber and Lyft pull out of California?

California is home to two major cities for ride-hailing and food delivery platforms: San Francisco and Los Angeles. Platforms that don’t require workers to be in the same place as customers (for example, UpWork, translation platforms, etc.) may choose to not operate in California. But the largest platforms, and those spending on passing Prop 22, require workers and customers to be in the same place, and California accounts for ~40% of their U.S. business, so… extremely unlikely they’ll pull out.