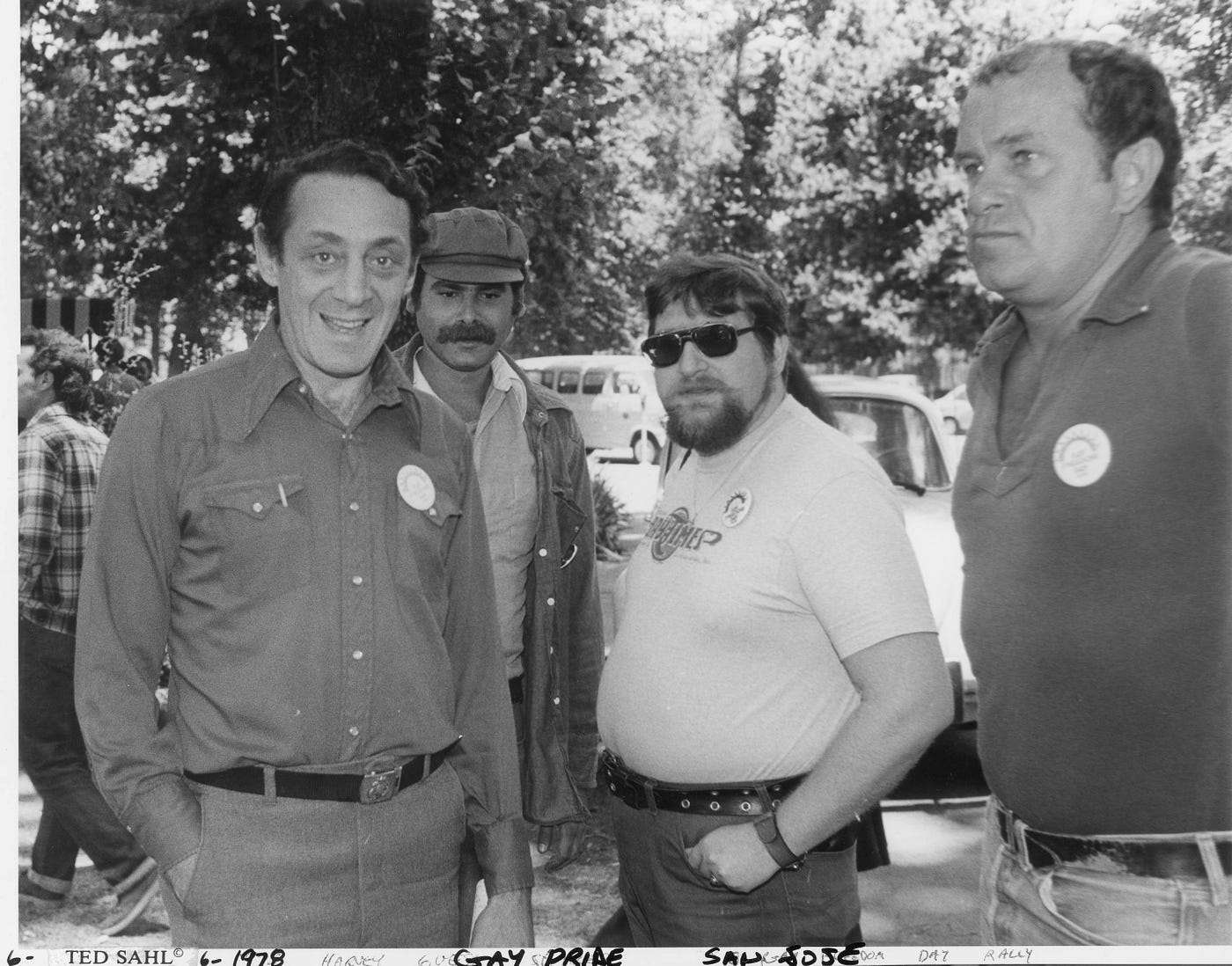

It’s hard to say what Harvey Milk would think if he were to walk down Castro Street today, past all the empty storefronts that exist as the residue of a real estate market hostile to the small businesses that once occupied them. What would he say were he to stumble upon his old camera shop, now a Human Rights Campaign gift shop nestled between a Wells Fargo and, ironically, a property-management company?

For many reasons, Milk would probably be more than a little sad. First off, because it’s the site of his own eviction — when his rent quadrupled in 1977, he was priced out of the property that had been his residence and campaign headquarters for years. When a city supervisor is evicted, that really says something, both about the stressful financial climate of the time and the unorthodox lifestyle of the supervisor, which placed him, socioeconomically, right alongside all those renters he was representing.

Milk’s unpassed ordinance—known officially as the “Real Property Transfer Tax Ordinance”—took such an impressively hard stance against unethical speculation practices that it could have thrown a wrench in the whole house-flipping industry.

But it also stands as evidence that the movement for housing rights for San Francisco’s working class isn’t much further along now than it was 40 years ago, despite Milk’s best efforts to elevate them. The ’70s, like today, were a time of rapidly rising housing prices and aggressive gentrification, more commonly referred to at the time by the benign misnomer “urban renewal.” If Milk’s famously grassroots-community-organizing tactics hadn’t done so already, his own eviction certainly would have put him in a position to empathize with the thousands of others affected by San Francisco’s rampant displacement epidemic in the 1970s, a precursor to our current one.

Though the term “speculation” feels antiquated, it is still sickeningly relevant to a generation that now has a real estate mogul as a president. Speculators prey on neighborhoods made vulnerable by the sways of development, usually justified under the guise of property rehabilitation and community revitalization.

Of course, Harvey Milk isn’t here today, so we can never know for sure. But could his own experience fighting for housing rights have been a reason why he began adamantly piloting a groundbreaking real estate tax in the last year before his death in 1978?

The ordinance, known officially as the “Real Property Transfer Tax Ordinance” and not widely available to the public until now, took such an impressively hard stance against unethical speculation practices that it could have thrown a wrench in the house-flipping industry—that is, had it passed and then managed to survive four decades of legislative pushback that surely would have ensued, which some housing experts today argue is unlikely. Milk’s exact proposal in a nutshell: an 80 percent tax on the profits made off of any short-term residential speculative purchases if they were resold after less than one year of ownership. That is to say, anyone looking to make a quick flip and a lucrative sale at the expense of a neighborhood’s long-term residents would be facing quite a big profit disincentive, while at the same time those homebuyers looking to make a legitimate stake in the community would be protected.

Harvey Milk threw some legislative shade when he wrote the following into his ordinance:

There exists in San Francisco a situation in which short-term speculation in the residential housing market is artificially inflating the cost of home-ownership and rental units beyond the financial reach of lower- and middle-income households.

Sound familiar?

A transfer tax on short-term speculative profits from the sale of residential real estate is desirable because it will operate as a disincentive to such speculation and will assist in maintaining the cost of residential real estate within the financial reach of lower- and middle-income households.

But wait, the parallels continue:

A transfer tax…is desirable because 1) the tax is imposed on a group which has benefitted greatly from the governmental services which create an environment conducive to capital appreciation of residential real estate, and 2) the tax is imposed on a group which generally is well able to pay such tax on such profits.

Despite numerous amendments and reattempts, when Milk died on November 27, 1978, so did the anti-speculation ordinance — and with it, the hope of setting a precedent of power for working-class tenants. Yet before the ordinance was lost to time (until its rediscovery this year, that is), it did manage to spark a dialogue that was foundational to the way progressives approach housing and urban-land usage, specifically in the ongoing battle against speculation.

First, though, we must fully understand the monster that is speculation. Though the term “speculation” feels antiquated, it is still sickeningly relevant to a generation that now has a real estate mogul as a president. Speculators prey on neighborhoods made vulnerable by the sways of development, usually justified under the guise of property rehabilitation and community revitalization.

In the words of Tommi Mecca, director of counseling programs at the Housing Rights Committee of San Francisco, speculators are “just being good little capitalists.” Sarcasm drips from his words. Mecca originally got involved in housing rights in the ’90s after witnessing tenants with AIDS being evicted in the Castro—just one of many housing injustices perpetrated against those already at the margins of society.

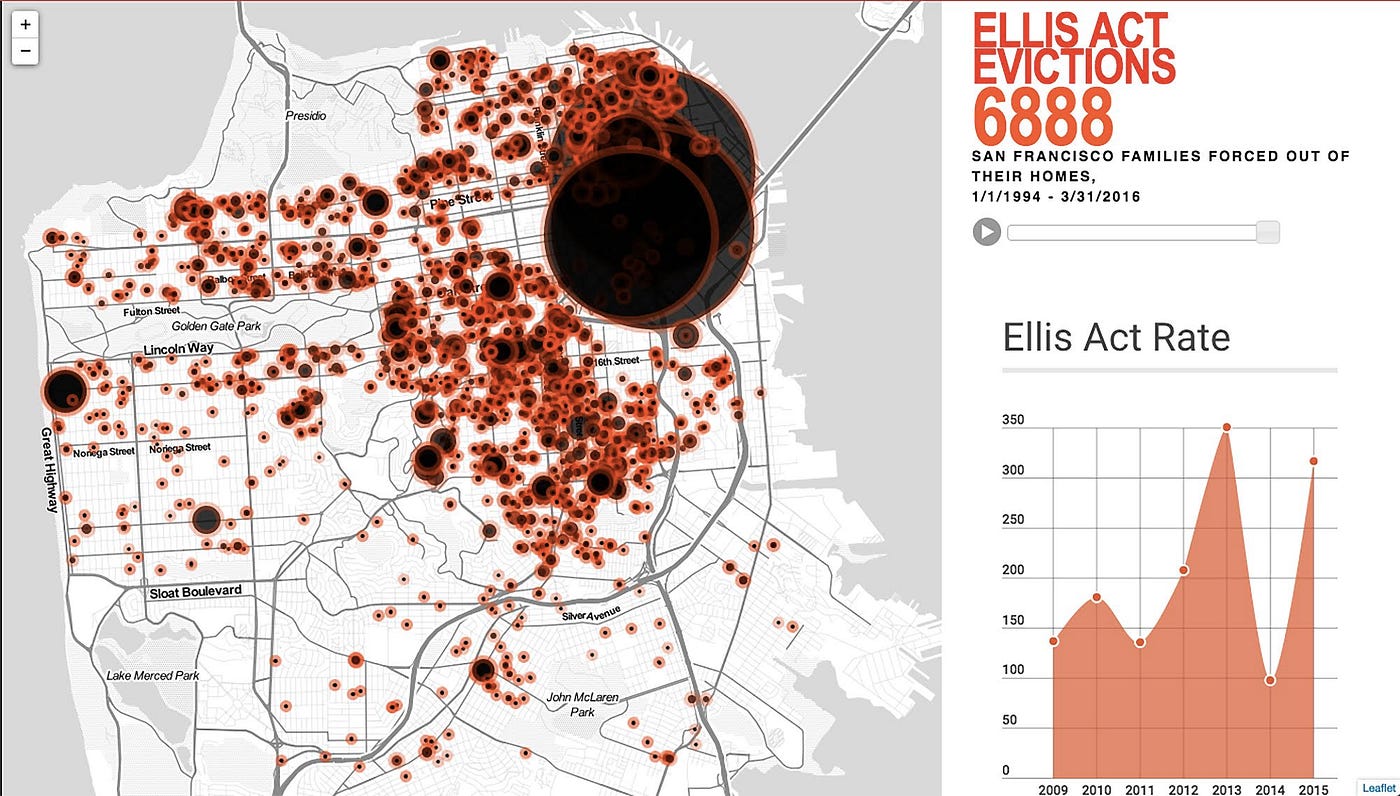

Mecca counsels San Francisco tenants in danger of eviction due to a variety of legal speculative means. Some, like the Ellis Act of 1985, which allows landlords to unconditionally evict all tenants by purposefully “going out of business,” or the Costa-Hawkins Rental Housing Act, which subverts rent control by making all single-family homes built after 1995 exempt, are written into state legislation. Others, such as prolonging construction until tenants move on, or even tenant harassment, are less easily assessed but prevalent throughout the city. For him, the root of the problem is as simple as the commodification of housing, when it should be treated as a right.

“Putting [human needs like housing] on the free market doesn’t work. Profit drives it in such a way that it excludes some people,” he said. If only the solution were equally simple. “The whole game of speculation is that there’s huge, huge profits. And when there’s profits to be made and you try to stop that, people are going to fuss with it….How do you inhibit this in a way that doesn’t mess with their right to make money? Should it be their right? No.”

“San Francisco is a great place to visit. But you can’t live here anymore.”

It’s tricky business when legislation and government is concerned, as Harvey Milk surely experienced while trying to get such a radical bill passed in a system that was trending toward giving bonuses and incentives to these land entrepreneurs (a nicer name for a group that more accurately might be called “speculative vultures”). From Milk’s era onward, the city government had decided to remake San Francisco to give it prime access to international markets — a then-common moniker was the “Manhattan of the West” — and thus sought to centralize it with a flashy downtown and a series of highways cutting through working-class neighborhoods, displacing families in their wake. Down with duplexes in the Mission and the Haight, up with the Transamerica Building.

The promotion of “boosterism,” or the project to make San Francisco a city with worldwide tourist appeal upon which the government could make money, was also to blame at the time. The ordinance document, which includes with it a number of op-eds and citizen appeals that throw light on the depth of the controversy Milk sparked, touches upon this several times. In a piece of organizing literature printed by the American Friends Service Committee, the consequence of aggressive speculation is put bluntly: “San Francisco is a great place to visit. But you can’t live here anymore.”

Recall, this was a generation before Airbnb could have been conceived, much less given the chance to deplete the housing market by incentivizing landlords to convert long-term rentals to short-term rentals.

Milk cited horror stories from the SF Tenants Union: a disabled vet living at 1725 Turk Street who complained about garbage and then received a 30-day eviction notice. A seven-year resident with six kids on dialysis evicted from 183 Noe Street, despite needing to live near a hospital.

Renters, seniors and young couples looking to buy their starter homes—permanent housing in 1978 was beyond reach of anyone who actually wanted to live in the city. The text of Milk’s ordinance is laced with thoroughly investigated examples and personal accounts that detail the extent of speculation’s destructive habits. He made it easy for us readers in 2017, suffering the same afflictions, circling in pencil particularly acute instances of speculation he perhaps hoped to draw attention to.

Some of the examples Milk gives in the ordinance include the following: 1210 York Street in the Mission. Purchased for $75,000 and resold three months later for $84,000. No rehab permits were taken out, yet the rent tripled in that time. Or 136–138 27th Street in Noe Valley. Purchased for $52,000, only to be resold on the same day for $85,000. Again, no rehab permits were taken out. And 700 12th Avenue in the Inner Richmond. Resold four times between 1970 and 1977, with the price jumping from $62,500 to $265,000. No rehab permits could be found.

Milk lists dozens of these examples, many in minority neighborhoods like the Mission, Chinatown and the Fillmore District (once known as the “Harlem of the West Coast”). If one tracks the addresses, a lot pop up in SOMA, although of course it wasn’t yet known by the trendy acronym it now goes by.

Milk cited horror stories from the SF Tenants Union: a disabled vet living at 1725 Turk Street who complained about garbage and then received a 30-day eviction notice. A seven-year resident with six kids on dialysis evicted from 183 Noe Street, despite needing to live near a hospital. These stories sound pretty much the same as the ones we hear today.

A testament to Milk’s ability to mobilize at the grassroots level is the diversity of the cohorts who endorsed his ordinance, which seemed to include nearly everyone along the spectrum of marginalization. The SF Human Rights Commission, the Archdiocesan Commission on Social Justice, the Bay Area Women’s Coalition, the SF Black Political Caucus and the SF Gay Democratic Club, to name just a few. At his core, Milk was a champion of the working class, and although we can only really guess at what San Francisco would look like had he not been assassinated and the anti-speculation ordinance had been given a fair shake, it’s a pretty safe bet that it could have served as a model ordinance for the housing-rights movement.

Milk may not have been successful in passing his ordinance, but in his attempt, he compiled a document that sure speaks truth to the horrors of housing commodification. He warns of a future San Francisco that is hostile to the community he fought tirelessly to represent, should that dialogue not begin:

“The housing situation remains about the same following the incredible speculative orgy of 1977. In spite of increasing interest rates, grassroots interests in curbing speculation and fear of a crash, the market remains on a high plateau…If present trends continue, then the future is clear. San Francisco will become a city for the rich and the near rich. All others will have to leave or, in staying, pay more and more for less and less housing.”

Let us ask civic leaders now: will Harvey Milk’s predictions be taken to heart, or will we let these present trends continue?

The full text of Harvey Milk’s unenacted “Real Property Transfer Tax Ordinance” 120–78–1 is available on archive.org here.